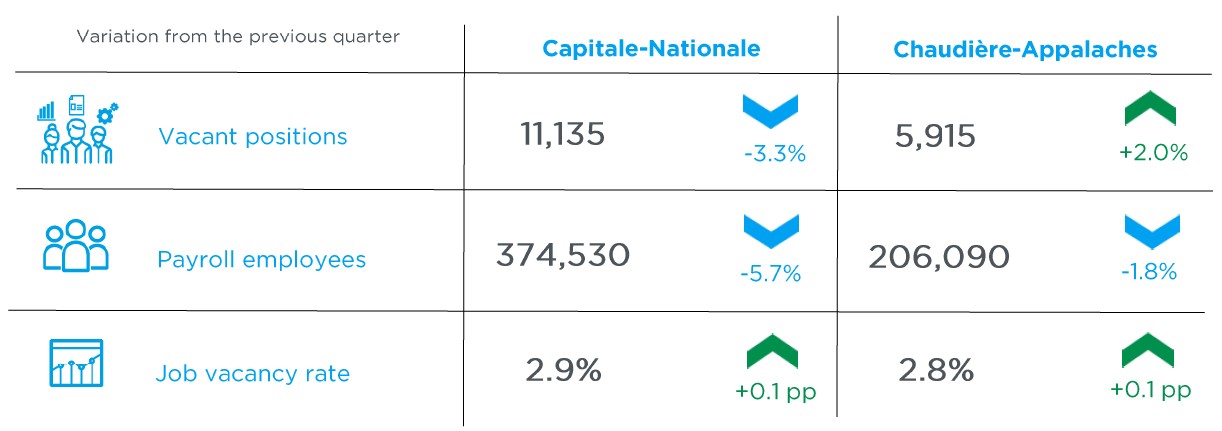

Highlights – Second quarter of 2025

Data visualization

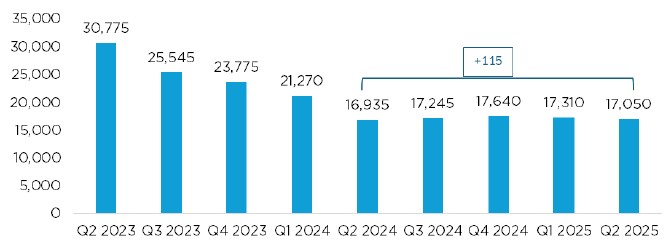

Graph 1. Evolution of cumulative job vacancies in the combined regions of Capitale-Nationale and Chaudière-Appalaches

Sources: Statistics Canada, Table 14-10-0398-01, and Québec International.

Sources: Statistics Canada, Table 14-10-0398-01, and Québec International.

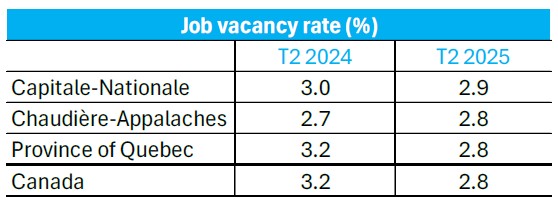

Table 1. Job vacancy rate by region

Analysis

Total job vacancies below 17,100 in Capitale-Nationale and Chaudière-Appalaches

According to Statistics Canada’s Job Vacancy and Wage Survey (JVWS), the number of vacant positions in the combined regions of Capitale-Nationale and Chaudière-Appalaches was 17,050 in the second quarter of 2025, compared to 17,310 in the previous quarter (-1.5%) (revised, seasonally adjusted data). This fluctuation is consistent with the relative stability observed over the past four quarters.

This trend suggests a form of stagnation in the integrated regional market, a reflection of the economic interdependencies between the Capitale-Nationale and Chaudière-Appalaches regions. However, some economic sectors continue to face recruitment challenges, which reveals a persistent asymmetry in the distribution of labour demand and supply, a factor that could influence the distribution of vacant positions across the different fields.

We should also note that, once again, this metric evolved differently in the two administrative regions, as the Capitale-Nationale registered a drop of 3.3% in vacant position this quarter, while the Chaudière-Appalaches region shows an increase of 2.0%. On an annual basis (Q2-2024 to Q2-2025), the number of vacant positions also fell in the Capitale-Nationale region, with a drop of 2.0%, while the number of vacant positions grew by 6.1% in Chaudière-Appalaches. Comparatively, this number dropped by 11.6% in the province of Quebec and by 12.6% in Canada over the same period.

Moderate progression of labour demand in the second quarter of 2025

Total labour demand includes job vacancies and payroll employees, but excludes people who are self-employed. This metric also evolved differently in each region. Between the first and second quarters of 2025, demand dropped by 5.6% in Capitale-Nationale and by 1.7% in Chaudière-Appalaches. On an annual basis, the two regions registered an increase of 1.3% and 2.3%, respectively, bringing the combined total to 597,670 jobs filled or vacant (+1.6%).

Although modest, this progression shows that the region’s labour market remains resilient despite persistent tensions in terms of skill alignment. It could also reflect a progressive stabilization of economic activity in a context where excess demand is still present in certain key sectors.

The average hourly rate continued its progression over one year, reaching $27.45 (+8.3%) in Capitale-Nationale and $27.70 (+8.4%) in Chaudière-Appalaches, based on non-seasonally adjusted data.

Rosalie Forgues

Economist

Québec International